The Third Wave in Telecoms Infrastructure

What is the Third Wave in telecoms infrastructure? In economics, the division of labour is the separation of tasks in any economic system or organisation so that participants may specialise. Specialisation in telecom infrastructure first emerged in the United States in the mid-1990s when executives from three companies (American Radio, Castle Towers and Steve Bernstein Associates) recognised the value of harnessing the potential of tower assets by selling space to multiple tenants. All three businesses established tower companies which are still known today: American Tower, Crown Castle and SBA Communications.

Passive Infrastructure is not “Core†to Mobile Network Operators. In the United States, mobile network operators (MNOs) soon realised that they are in the business of selling voice and data, and that passive telecom infrastructure really isn’t core to their business. Independent tower companies, for whom the management of passive telecom infrastructure is in fact a core business, typically have more expertise in identifying efficiencies and reducing operating expenditures (OPEX). In addition, tower companies tend to have a lower cost of capital than MNOs, and they have greater co-location (site sharing) ratios on their masts. EY-Parthenon has shown that a typical point of presence (PoP) managed by an independent tower company is 46% more efficient than one managed by an MNO.

All Three Large U.S. MNOs have Divested their Passive Infrastructure. As a result, all large U.S. MNOs have sold (or leased) their masts to infrastructure companies: in 2012, Crown Castle paid T-Mobile $2.4 billion for a long-term deal involving 7,200 masts (some sold, some leased). Similarly, in 2013, Crown Castle paid AT&T $4.85 billion for a long-term lease of 9,100 masts. And in 2015 American Tower paid Verizon Wireless $5.1 billion for a long-term lease of 11,300 masts. Many smaller deals have closed as well.

Europe has followed suit. In recent years, European MNOs have also begun to sell. Some have started with the (less efficient) step of creating MNO-controlled tower companies (Deutsche Funkturm, Telxius, Vantage, TOTEM). But others have taken the “leap†to full specialisation. For example, in Spain, MNOs (Telefonica, Yoigo, Masmovil and Orange) have sold almost 8,000 towers to Cellnex over the last decade. In France, Bouygues has sold more than 6,000 towers to Cellnex and FPS Towers, and Iliad sold 70% of its tower portfolio to Cellnex. In Italy, Wind sold 7,400 towers to Cellnex, and CK Hutchinson sold another 8,900, also to Cellnex. And in the UK, Cellnex recently acquired Arqiva, along with 6,000 masts from CK Hutchinson.

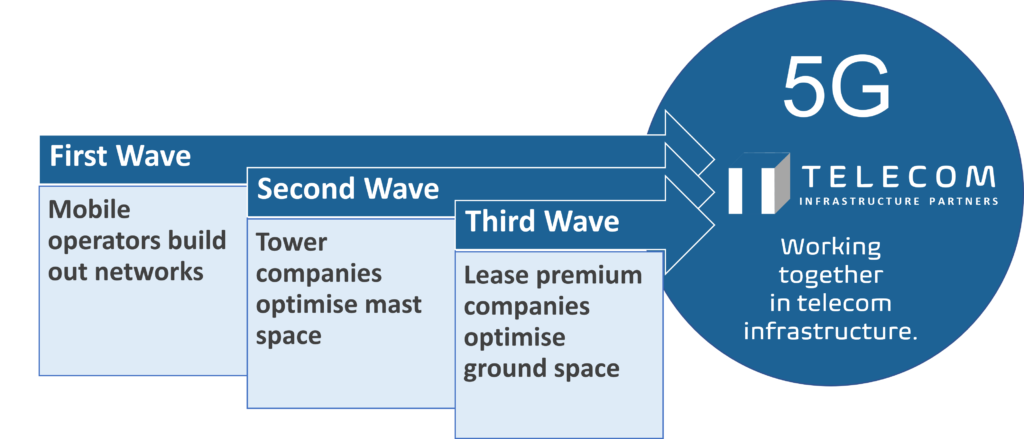

Three Waves. One might picture these developments as “waves.†The First Wave would be the initial development of networks by the MNOs themselves. The Second Wave would be the sale of passive infrastructure to tower companies.

The Third Wave started in the United States as well. Wireless Capital Partners (WCP), the first U.S. telecom ground lease aggregator, was established in 2001. Unison Site Management (Unison) soon followed, in 2003. Unison improved upon WCP’s model in that Unison began to acquire “telecommunications easements†rather than mere leasehold interests (and it turned out that telecommunications easements, which are stronger property rights, did better in 2009-2010 during what became known as the Great Recession). Mr. Overman, who was an international tax and structured finance lawyer at the time, first helped a company by the name of MD7 move into the site lease aggregation space in 2004, which was also the year in which Communications Capital Group was founded (now TowerPoint). Telecom Lease Advisors (now Lease Advisors) was established in 2008. Finally, Mr. Overman established Wireless Infrastructure Partners (WIP) in 2009, and Landmark Dividend followed in 2010.

Mr. Overman and his Team at WIP took U.S.-style Mobile Site Lease Investing International. After having closed approximately 1,000 mobile site lease investments in the United States, Mr. Overman and the company he founded, WIP, first took U.S.-style mobile site lease aggregation international. This was a logical step, because competition among U.S. lease aggregators was driving down margins; the aggregators were competing over some 300,000 sites in the United States, but the international market, which comprised several million sites, was wide open. In addition, Mr. Overman was a dual European/U.S. citizen, who had been born and raised in the Netherlands (one of the most open and multicultural societies in the world) but had been educated as a professional in the United States (at Georgetown Law School and its School of Foreign Service).

Mr. Overman applied WCP’s approach of buying leaseholds in common law jurisdictions (Australia, Canada, the UK), where Unison-type “easements in gross†do not exist. He then replaced easements with the (originally roman and well-worn) concept of usufructs in civil law countries (France, Spain, Italy, Mexico, Brazil, Chile and Colombia). Other jurisdictions required a more customized approach. Mr. Overman oversaw the investment in approximately 6,000 sites in 20 countries in less than a decade. Landmark Dividend and Lease Advisors followed Mr. Overman into English-speaking jurisdictions only (Canada and Australia). But everywhere else in the world, Mr. Overman faced (and continues to face) little or no competition. At TIP, Mr. Overman continues to innovate, moving into new markets like Denmark and the Czech Republic, with other jurisdictions and additional asset classes already planned.

Tower Companies as an “Exit Strategy†for Lease Aggregators. Although the Third Wave was new to MNOs and tower companies alike, tower companies quickly became the “exit strategy†for lease aggregators. American Tower bought 1,800 site lease investments from Unison in 2011 (and Unison exited the space). Crown Castle bought 2,300 from WCP in 2012 (and WCP, too, is no longer active). InSite Wireless Group bought Lease Advisors in 2014, and was then acquired by American Tower in 2020. Landmark Dividend was acquired by Digital Bridge in 2021.

Telecom Infrastructure Partners at the Forefront Again. The acquisition of more than 6,000 mobile site leases by Mr. Overman and his teams allowed WIP’s investors to go public in 2020. Mr. Overman established Telecom Infrastructure Partners (TIP) in February of 2020 and immediately sought and obtained the capital commitment required to help push the Third Wave to its logical conclusion ($350M in equity which, in combination with debt, will provide TIP with well over $1 billion to invest). After an 18-month sabbatical, Mr. Overman launched TIP’s operations on 1 September 2021.

Time for Agreement. The logical conclusion of the Third Wave is, of course, a further division of labour and efficiency. A few years ago, an executive at American Tower with whom Mr. Overman negotiated tenant-sponsored site lease investment programs across Latin America said it best: “the wireless operators should specialise in voice and data, tower companies should specialise in steel, and ground lease aggregators should specialise in land.â€

The problem has been that mobile site lease investors have sought the “upside†associated with steel instead of recognizing that mobile site lease investments resemble “Triple Net†lease investments in other asset classes: whereas tower companies maintain their share prices by pursuing growth (organically by pressing MNOs for higher rents and by co-locating additional tenants, as well as through M&A), a well-managed lease aggregator has complete “goal congruence†with its tenants, the MNOs and tower companies. Both parties seek long-term, predictable, “bond-like†rent flows.

TIP is Prepared to be 100% Controlled. For this reason, TIP is prepared to be 100% controlled by its tenants, the MNOs and tower companies. Our business model is to invest in mobile site leases “as we find them.†We are NOT venture capital-type investors that seek to maximise the return on a finite tranche of investments through aggressive re-negotiation. Instead, we are building a high quality, global portfolio of long-term, predictable cash flows – like a bond, not a stock. TIP is prepared to relinquish every opportunity to renegotiate by entering into enhanced leases (or master lease agreements) with its tenants that are co-terminous with TIP’s investment. This means that MNOs and tower companies get the pricing and operating terms and conditions they desire – without having to worry about any re-negotiation. TIP will seek a reasonable return, about which it will be fully transparent.

As an aside, this approach is identical to the approach taken by WCP, and Unison, and Landmark Dividend. U.S. MNOs worked with these lease aggregators to safeguard strategic sites under predictable terms and conditions. It makes no sense for a site lease investor to negotiate aggressively with large, publicly-traded, well-capitalised tenants. It makes even less sense to do so across many jurisdictions on multiple continents.

Three Examples of the Third Wave. TIP will continue and improve upon Mr. Overman’s track record by acquiring mobile site leases (and mobile switching centres, DAS and data centres) independently and at a rapid pace. But TIP is well-positioned to help MNOs and tower companies specialise further, thus completing the Third Wave. Here are some examples:

(1) Tenant-sponsored Lease Premium Programmes. TIP can help create a “win-win†between, on the one hand, property owners and, on the other hand, MNOs and infrastructure companies. This is because TIP’s ability to pay large, up-front lease premiums to property owners does NOT depend on renegotiation of the site lease at renewal. Instead, TIP takes advantage of the fact that the property owner faces “binary riskâ€: either the mobile site lease pays rent (“1â€) or it is terminated (“0â€). TIP of course faces portfolio risk (rather than binary risk): if a particular site lease is terminated, TIP is hedged by thousands of other site leases. Logically, this means that there is always a payout price that is attractive to both TIP and the property owner. In a rational world, 100% of site owners should sell! The attractiveness of lease premiums has been confirmed in the marketplace: more than 25,000 site lease investments have now been made world-wide.

The MNO or infrastructure company wins most of all in this scenario because TIP is prepared to enter into an enhanced lease (or multiple site agreement, MSA) that provides the MNO with all the operational flexibility it desires (e.g., “expansion of use†and “expansion of premises†language to support 5G roll-outs), along with reasonable rent reductions. The MNO or infrastructure company controls TIP and the property owner 100% because the enhanced lease or MSA is co-terminous with TIP’s investment. TIP will never have the ability to renegotiate – and the MNO or infrastructure company will still be able to terminate as required.

(2) Breaking the Impasse resulting from the 2017 UK Electronic Communications Code. In the UK, reform of the Electronic Communications Code (ECC) was designed to help achieve ubiquitous coverage and greater capacity –particularly as it relates to 5G. Mobile operators have used the Code to achieve (sometimes dramatic) rent reductions, and property owners have pushed back.

We have already seen more court decisions under the 2017 Code than during the entire 30 years the previous Code was in force, and the Tribunal has warned against delays. The government is investigating whether changes might be needed, but the Law Society says that changes to the Code and procedures are not enough.

Ofcom says that the parties should seek agreement, and we at TIP think we can help. More than 25,000 site lease investments world-wide have shown that mobile site owners like lease premiums. Thousands of site lease premiums have been paid in the UK. As indicated above, TIP’s willingness to pay large lease premiums does NOT depend on future rent increases. In fact, we are prepared to accept rent decreases as intended by the new ECC. Our business model is based on long-term, predictable, “bond-like†cash flows, whatever they happen to be. Our return does NOT depend on future, negotiated “upside.â€

We have also NOT taken a position relative to the new ECC, so we can help “break the impasse†between, on the one hand, site owners and, on the other hand, MNOs and infrastructure companies. Our low cost of capital allows us to pay large lease premiums to site owners, while offering MNOs and infrastructure companies the benefits they seek under the new ECC.

TIP is a facilitator only, and is willing to be controlled 100% under contract. Our job is to provide the capital to “break the impasse.â€

(3) Ground and Infrastructure Sale-leasebacks. The sale-leaseback process is straightforward. TIP acquires rights to be property, as a freehold or through a headlease or usufruct. TIP then leases the property back to the MNO, which maintains 100% control over TIP.

The MNO uses the proceeds as desired, in profitable “core†activities, like technology roll-outs. There are many benefits to sale-leaseback financing:

- Recover prior capital expense (CapEx) while maintaining 100% control;

- Get 100% of asset value (no loan-to-value ratio);

- Improve debt-to-equity ratios, avoid triggering debt covenants;

- More flexible than debt financing (10-30 year term);

- Turn a depreciable asset into cash;

- Protect the asset from independent third party buyers.

The MNO will maintain full control over the asset. TIP is a purely financial counterparty, not a competitor. Our lease arrangements are “Triple-Net†and “bond-like.†The MNO locks in pricing, terms and conditions – there will be no renegotiation. Monetize:

- Masts;

- Mobile switching centres (MSCs);

- DAS; and

- Data centres.

U.S. MNOs have protected themselves by entering into sale-leasebacks of core assets with various counterparties. For example, when AT&T sold an additional 1,000 masts in 2019, it did not sell them to Crown Castle (which had bought 9,100 of its masts in 2013). Instead, it did a deal with Peppertree. Similarly, when Verizon decided to enter into a $650M sale-leaseback of its New Jersey operations center in 2015, it did so with Mesirow Financial rather than with American Tower. European MNOs should similarly consider counterparties that do not already control their mast portfolios. In fact, to really complete the Third Wave (optimal specialisation without relinquishing control), MNOs might consider entering into ground sale-leasebacks with TIP, while pursuing sale-leasebacks of steel, equipment or even buildings on top of the leased ground with third parties. Maximum proceeds, maximum control.

TIP offers by far the most experienced team in the mobile site lease investment space:

- In 2000-2009, Mr. Overman advised Fortune 500 companies on more than $4 billion of “big ticket†lease financings;

- In 2010-2019, Mr. Overman took U.S.-style mobile site lease investing international, closing 6,000+ transactions (valued at another $1 billion)

With TIP, Mr. Overman and his rapidly expanding team are further improving upon and accelerating this impressive track record as thought leaders and innovators in the space.